ONLINE COLLECTION BASKET

-

Outreach Offerings for February

Our February Justice Outreach Offering will support the Linn Benton NAACP. The NAACP works to ensure the political, educational, social, and economic equality of rights of all persons and to eliminate race-based discrimination.

Learn more at the Linn Benton NAACP Website.

How to donate to the monthly Outreach Offering

Each month, the Fellowship gathers donations for a certain charitable cause. These are our Outreach Offerings. You can contribute to this month’s offering in a few ways:

- Give to the Sunday collection basket

- Donate online

- Donate to the refreshments during the social hour

The Kitchen team donates an assortment of sweet and savory refreshments, including gluten-free and vegan choices, for our enjoyment at the social hour following Sunday worship. These items are purchased and prepared by the team to encourage donations to the Outreach Offering. Collection baskets are always found at the ends of the refreshments table. The next time you’re eyeing something tasty on the table, consider putting a donation in the basket first to show how much you appreciate having that treat ready and waiting for you!

Like the physical baskets we pass when meeting in person, you can choose to donate to the Outreach Offerings, or donate to the Operations of our Fellowship, or donate to both!

To change the fund you’re donating to, simply click on the arrow next to “Give to …” and select from the drop-down menu. You can also select a one time or recurring donation, and credit card or bank transfer.

STEWARDSHIP DRIVE 2025-2026

Each spring the UUFC asks its members and friends to make a commitment of financial support (a pledge) for the coming fiscal year (July 1 to June 30). Our Annual Pledge Drive provides the funds that make the life of our Fellowship possible.

Frequently Asked Questions

What is the Annual Stewardship Drive?

What are personal Involvement Commitments?

What If I Currently Do Not Have the Financial Capacity to Make a Pledge?

How is a Pledge Different from a Contribution?

Is a Pledge Required for Membership?

Is There a Minimum Annual Pledge?

What Do We Get Out of UUA Membership?

How Much Did UUFC Members Pledge in 2024-25?

How Do I Fulfill My Pledge? What Are My Payment Options?

Can I pay my annual pledge as a single lump sum?

What If I Cannot Pay My pledge?

Can Collection Basket Offerings Be Used in Place of Pledging?

What is the Annual Stewardship Drive?

Each spring, the UUFC asks its members and friends to make both a personal involvement commitment as well as a commitment of financial support (a pledge) for the coming fiscal year (July 1 to June 30). Our Annual Stewardship Drive provides the person-power and funds that make the life of our Fellowship possible.

Our real goal is to give everyone an opportunity to reconnect with the Fellowship and to reflect on:

* what brings you here,

* what keeps you coming back,

* our personal and spiritual commitments to each other and to our world,

* the fact that giving can be a spiritual practice.

What Are Personal Involvement Commitments?

At a minimum, we would like every member and friend of the UUFC to make a commitment to become involved in the life of the Fellowship in some way. For some this could be as simple as committing to engage in a short conversation with at least one person you do not know any time you are at a UUFC function/event/service. We are a community, and community requires knowing at least a bit about each person in it. For those with more time, interest, capacity and capability, there are an array of volunteer opportunities in the UUFC. We need people to do “manual labor”, to assist with mowing lawns and tending our grounds and buildings – painting, annual floor cleanings, leaf raking, roof clearing, etc. We need people to help greet others as they come to services. We need people to provide leadership in exploring and nurturing our religious life, connecting with others, and doing needed tasks. Use the bottom portion of the stewardship form to indicate areas where you are willing to provide assistance.

What is a Pledge?

A pledge is a commitment to donate a certain amount of money to the Fellowship during the fiscal year. It is a statement of intent. It is not a legally binding obligation. Do not hesitate to pledge because you are uncertain about your financial situation. Pledges can be adjusted in times of shifting resources. We depend upon your pledges for the continued health and wellbeing of our Fellowship.

Who Should Pledge?

Everyone! Everyone for whom the Fellowship is important in any way. We depend on those who have signed the membership book as well friends of the Fellowship to make a pledge. We know some folks who are hesitant, for different reasons, to formally become UUFC members, but have made a long-term commitment to the Fellowship. All are needed, and appreciated! If you have found any of our online or in-person activities to be of meaning to you, make a pledge. If the life and the work of the Fellowship makes a difference in your life, make a pledge of support! Doing so will allow us to extend these same benefits to more people in our community and beyond.

What If I Currently Do Not Have the Financial Capacity to Make a Pledge?

Our hope is that all members and friends complete a stewardship form even if they state that their pledge is for zero dollars. There is an option on the form for such – “I am unable to pledge this year.” We understand that all personal situations are different and that some people will not be able to contribute to the UUFC financially, but we want to know that you are with us in community and will contribute in whatever ways you can. In community, we count on those with the capability to make a larger pledge to help carry the load for those who cannot.

How is a Pledge Different from a Contribution?

A pledge is a commitment for on-going support. On the other hand, a contribution is a gift that is appreciated and valued, but it is not something the Fellowship can count on in the future. We gratefully receive contributions to our general operating fund, building fund, endowment fund, or our monthly charity. Contributions may be mailed to the Fellowship or put into the Sunday collection basket. Make your check payable to UUFC and indicate if it is for the operating or another fund.

Is a Pledge Required for Membership?

We expect all members of the Fellowship to participate in the pledge drive each year, even if for some reason they cannot make a financial pledge. If we don’t hear from a member for 2 years in a row, we do remove them from the active membership list, which is the list of names we report to the UUA as our official members each year. But you can be involved with the UUFC without pledging. UUFC members and friends expect the Fellowship not only to provide worship and religious education for us and our families, but we also count on the Fellowship to be here for us in intensely personal ways: when we celebrate, when we grieve, when we work for justice. The Fellowship strives to be a community that supports us throughout our whole lives. In addition, we want the Fellowship to thrive and to continue to be a vital resource not only for ourselves, but for our communities, the world and the future. The Annual Stewardship Drive is the time of year when we each consider what personal time commitment and financial support we can offer the Fellowship so that it is able to function and serve when it is needed most.

When Should I Make My Pledge?

During the Stewardship Pledge drive each spring, we ask our members and friends to renew their pledge of personal time and financial support to the Fellowship. Financial commitments support our work and mission and allow us to set the budget for the operations of the Fellowship. We welcome your financial pledge at any time, but pledging during the Annual Stewardship Drive allows our Board to create a budget for the coming fiscal year with greater confidence.

New members and friends who join us at other times of the year are invited to make a personal time commitment and financial pledge for the remainder of the current fiscal year.

How Much Does It Cost to Run the Fellowship?

Our proposed annual budget for 2025-26 is ~$515,000. These funds pay for our staff (~75% of our budget), provide for all the utilities and maintenance of our buildings (~10%), and provide for support of the rich array of services, programs and social outreach we offer.

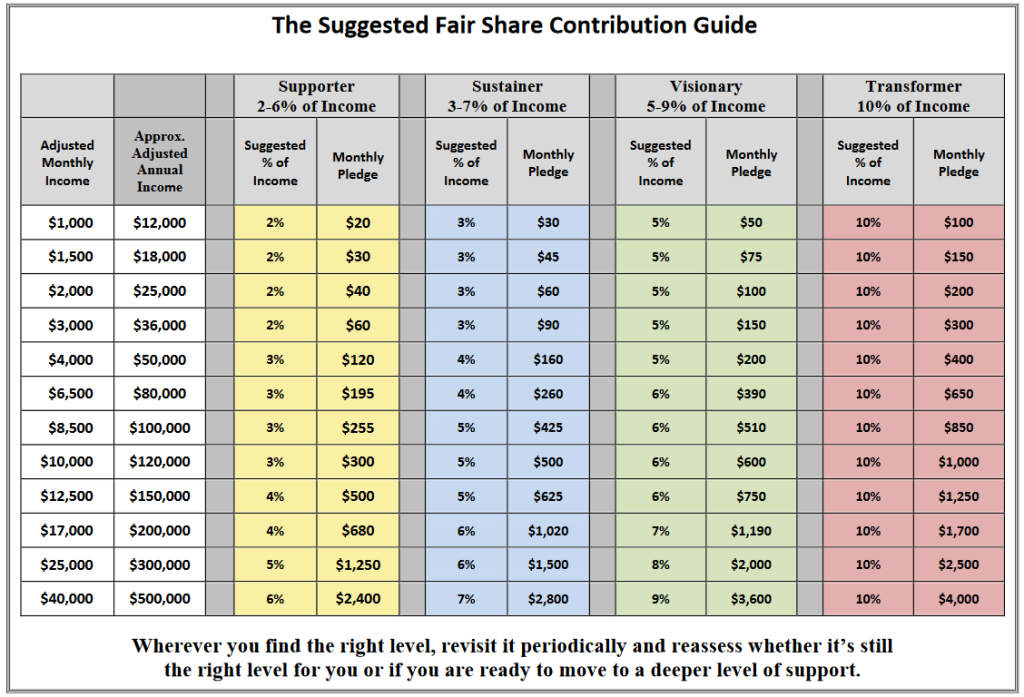

How Much Should I Pledge?

Everyone’s circumstances are different. We recognize and deeply embrace the financial diversity of our congregation. To make this a Fellowship for all, we ask that those who are able, consider carrying a greater financial commitment to our beloved community. We ask all Fellowship members and friends to pledge generously within their means. Or, as some have said, “Give until it feels good.” We each are asked to reflect on what that amount might be.

It might help individuals and families to know that in order to meet our current 2025-26 fundraising goal of $440,000 in pledges, we need at least 250 pledges at an average pledge of $1,760 per pledging unit (individual, couple or household making a pledge). Of course, not everyone can pledge that amount, so we have always counted on others who can pledge much more to do so.

We ask our members to consider pledging a percentage of their annual income. The UUA has developed a Fair Share Giving Guide, with 2% of annual income considered as a target for “fair share” giving. This is simply a guide – some of our members pledge at higher levels and others at lower levels, based on their capability. For those interested in numbers and details, see the pledging worksheet at the end of these FAQs for one approach to determining fair share.

Is There a Minimum Annual Pledge?

There is no minimum annual pledge; however, we pay annual “dues” to the national Unitarian Universalist Association (UUA). The amount we share with the UUA is based on our annual budget. In 2024-25 that amount was $31,125 which is about $160 per pledging unit in the UUFC (individual, couple or household making a pledge). The UUFC has been a UUA “Honor” congregation for more than 26 years! (Read the UUA article “Congregational Recognition.”) This means that we have given the full amount that the UUA has requested, based on our annual budget level, in each year. Though there is no minimum requirement for a pledge at the Fellowship, we have long suggested that all members aim to pledge at least that $160, helping to support the cost of the Fellowship being served by the UUA.

What Do We Get Out of UUA Membership?

Each UU congregation is autonomous—congregational leaders set their own priorities and choose their own ministers and staff. Congregations vote for the leaders of the UUA, who oversee the central staff and resources. The UUA supports congregations in their work by:

- * Training ministers and providing interim minister support

- * Providing religious education curricula

- * Group services – Zoom license; staff insurance coverages; staff, finance team, and other group networking, etc.

- * Managing the UU Common Endowment Fund to strict UU standards

- Publishing books and the UU World magazine

- Coordinating social justice activities

- More

(* services we continually use)

How Much Did UUFC Members Pledge in 2024-25?

A quartile analysis is a common way to look at pledge range in a group. Here is the UUFC quartile analysis for 2024-25. Note pledge range is $60 to $13,500.

How Do I Fulfill My Pledge? What Are My Payment Options?

- Automatic Withdrawal through your bank – Our preferred method is to have your pledge automatically deducted from your checking or savings account using your bank’s bill pay system. Via such a system, your bank sends a check to the UUFC. Such payments are most cost efficient for the UUFC. We do not have to pay a service fee.

- Automatic Withdrawal through Breeze – You can use your Breeze account to set up an automatic transfer from your bank checking or savings account. There is a small fee imposed by Breeze to shepherd these transactions. If you have a monthly pledge already set up in Breeze, sometime in June, please login and put an end date for last year’s pledge and set up your new monthly pledge starting in July 2025. Please contact Jamie Petts if you need help accessing your Breeze account.

- Credit Card – If you want to pay by credit card in Breeze, please consider adding 3% to your pledge amount to cover the fees we pay for those transactions. These fees are in addition to the fee Breeze charges for all ACH transactions.

- Check – Checks can be made out to the UUFC. Please write the word “pledge” in the memo line of the check. Checks can be mailed to the office at: UUFC, 2945 NW Circle Blvd, Corvallis, OR, 97330. They can also be placed in the mail slot to the right of the entrance on Circle Blvd.

- Retirement Account Required Minimum Distribution – for those who hold retirement accounts (401K, IRA and some others), who are 72 or older (if you were born on or after July 1, 1949), or those 70.5 and older (if born before July 1, 1949), you can have your required minimum distribution (RMD) transferred directly to the UUFC. The advantage of this for you is that you then do not have to pay tax on these monies. Contact your retirement fund advisor or tax advisor for details.

Can I pay my annual pledge as a single lump sum?

Yes, you may pay your pledge as a single lump sum. Some people do this by check, some by stock transfers, some by Required Minimum Distribution payments. If you are making a single payment and this will be done before the start of the new fiscal year (before July 1, 2025), please let the office staff know so that we can credit the payment to the correct fiscal year.

What If I Cannot Pay My pledge?

Financial hardship should never be an obstacle to Fellowship participation. Through good times and bad, we are all in this together. Waivers are available to any member facing financial difficulty. No paperwork needs to be filled out, there is no eligibility requirement, just indicate on the stewardship form that you are unable to make a financial pledge or have a quick conversation with our minister. Reverend McAllister and our forthcoming interim minister can be reached at minister@uucorvallis.org or 541-752-5218 ext. 101.

Is My Pledge Tax Deductible?

Yes, the UUFC is a 501(c)(3) non-profit religious organization recognized by the IRS. The Fellowship issues end-of-year tax letters showing total contributions made. If you made a financial contribution, you will get a letter in January letting you know the amount you gave.

Can Collection Basket Offerings Be Used in Place of Pledging?

While gifts of all kinds and amounts are appreciated, money put into the collection basket on Sundays isn’t enough to pay for the Fellowship’s expenses. Sunday offerings for UUFC use represent just 1% of our annual budget.

What About the Time I Spend Volunteering?

Members and friends of the Fellowship are encouraged to give regularly of their time as volunteers. Without our volunteers doing much of the Fellowship’s work, our paid staff budget would need to be much higher or this work would not get done. Members and friends of the Fellowship often find that combining volunteer time with their pledge has an impact in their lives and in the life of our community that goes beyond either separate donation. Through volunteering, you spend time with others whom you admire, cherish and learn to love. You can learn new skills and share yours with others. Memories are often made. Volunteers with councils and teams also help make decisions on how Fellowship funds are spent. We encourage you to combine your pledge with your volunteer time to further our collective goal of living our values. The bottom section of the stewardship form provides a place where you can indicate volunteer interests if you are not already engaged in such work.

I still have questions, who can answer them?

For additional questions please contact the UUFC office at office@uucorvallis.org or 541- 752-5218. Someone there will put you in touch with the pledge drive coordinator or Finance Council Chair who can answer your questions.

Determining Your Income for the Fair Share Giving Guide

UUFC Pledging Worksheet

Fiscal Year: July 1 – June 30

| Start with Adjusted Gross Income (from IRS form 1040) | |

| Add | |

| Tax-exempt pensions and annuities | |

| Tax-free income | |

| Depreciation on rental property | |

| Other | |

| Total Additions | |

| Deduct | |

| Non-reimbursed major medical expenses | |

| Care of parent(s) | |

| Care of higher education | |

| Cost of childcare | |

| Total Deductions | |

| Income to determine fair share commitment |

Budgeting and Stewardship

To learn more about budgeting and stewardship at UUFC, read this pdf created by Russ Karow, chair of the UUFC Financial Oversight Council.

LEGACY GIVING

A legacy gift to the Unitarian Universalist Fellowship of Corvallis (UUFC) is a way to use resources you have accumulated during your lifetime, whatever their level, to ensure that meaningful things happen at the UUFC now and in the future. UUFC legacy gift fund earnings support social justice activities, member crisis support, building improvements, religious education, and an array of other activities. Through a current gift or through estate planning, you will have the satisfaction of knowing that your gifts will support your personal values. Planned giving is not just for the wealthy. It can allow supporters at all income levels to make a meaningful gift that will have a lasting impact on our UUFC community.

Many UUFC members have given legacy gifts, had gifts given in their name, or have included the UUFC in their estate plans. Below is the current “to the best of our knowledge list” of legacy donors. Donations have ranged from $50 to $200,000. All gifts are encouraged and welcomed. Those shown below with an “X” behind their name gave several gifts, often times one “current” and another estate.

Mary Peffer

Alan Berg

Oliver & Helyn Worthington – 2X

Larry Callahan

Horice Drew

Ashley Molk

Lora Kelts

Charlie and Elise Ross – 3X

Rita McDonald

Lisa Bailey

Jane and David Loomis – 2X

Connie Foulke

John Lahr

Jack Culver

Molly Canan

Art Wilmot

Doris Tilles

Jim & Leona Deardorff

Isabel Harvey

Marjorie Goss

Suzanne & Bill Dannenbring

Janet Farrell

Louise Farrell

Russ and Marla Karow

Prue (Polly) Kaye

Roberta Smith

Claudia Keith and Marilyn Walker

Legacy giving can be smart investing. When you invest in the Fellowship through a gift to the legacy fund, you may realize a considerable reduction of income and estate taxes and can even obtain a current income flow, if creating a charitable annuity or trust. The purpose of this page is to stimulate your thinking. Unless yours is a simple cash donation or cash bequest that can be written into a template will, you will want to consult a financial advisor and/or lawyer to explore the best options for your individual situation.

Thank you for thinking about the UUFC as you consider your legacy. UUFC staff and Finance Council members will be happy to assist you at any time with information about gifts and bequests to the UUFC. Contact the main office at (541) 752-5218 if you would like assistance. We cannot provide financial, tax, or legal advice but we can talk with you about your ideas and then put you in touch with people who provide professional advice and assistance. A pamphlet on planned giving is available here – UUFC Planned Giving.

Lifetime Legacy Giving

UUFC members have given legacy gifts during their lifetime. They inherited funds or had extra funds when a business venture or activity had gone well. They established retirement accounts and were at the stage in life where the government was requiring them to withdraw funds from those accounts and were in the fortunate position of not needing these funds to meet daily living needs.

Gifts can be made to the UUFC legacy fund in the form of cash, equity, securities, real estate, vehicles, works of art, books, coin collections, or other tangible property. These gifts are exempt from capital gains tax and can qualify for federal and state charitable tax deductions to the allowed limits for your tax situation.

TYPES OF GIFTS

Cash – cash can be dropped off at the UUFC office during regular business hours, can be deposited in the collection plate on Sundays, or can be placed in the collection boxes outside the Fellowship Hall. If you want credit for the donations made in the collection plate or box, be sure to use an envelope with your name on it.

Checks – Checks can be made out to the UUFC. Please note on the memo line of the check what the donation is for – pledge, minister’s discretionary fund, social service project, etc. As with cash, checks can be placed in the collection plate or in the wall-mounted wooden box outside the sanctuary. They can be handed to office staff or mailed to the office at: UUFC, 2945 NW Circle Blvd, Corvallis OR 97330

ACH Payment – ACH payments are transfers from one of your bank accounts to a Fellowship account. The Fellowship can set up an automatic payment for you. To have this done, contact the UUFC Business Manager – businessmgr@uucorvallis.org. You can also make a one-time transfer or on-going transfers through our online payment account available here.

Credit Card – If you want to pay by credit card, if at all possible, please add 3% to your pledge amount to cover the fees we pay for those transactions. To pay by credit card, click here.

RMD Distribution – for those with retirement accounts (401K, IRA and some others) who are 72 or older, you may be required to make a required minimum distribution (RMD) from your accounts. Requirements have changed frequently in recent years. Check with your tax advisor on the current situation. If you are required to make a RMD, the advantage of this for you is that you then do not have to pay tax on these monies. You could use an RMD to pay an annual pledge or make a legacy contribution to the UUFC. Contact your retirement fund advisor or tax advisor for details. Checks can be mailed to the UUFC (2945 NW Circle Blvd, Corvallis OR 97330) or your broker can contact the Business Manager (businessmgr@uucorvallis.org; 541-752-5218) for the information needed to make an electronic transfer.

Stock Transfers – The UUFC is able to accept donations of stock and other equities. For information on how to make a transfer, contact the UUFC Business Manager businessmgr@uucorvallis.org or 541-752- 5218. Once we know that an equity is in our account, we will instruct our broker to liquidate that equity. After the sale, we will know its specific value. That value will be shown in your semi-annual UUFC donation report or if needed, a separate donation letter can be prepared. If you have additional questions, please contact the UUFC Business Manager.

Real Estate can provide an income tax deduction for the full value of the real estate and will avoid the capital gains tax on investment property. It is possible to make a gift of your home or vacation home that includes use of it during your lifetime under a life estate arrangement. Please talk with your tax and/or legal advisor about such gifts.

All Other Donations – While the UUFC has rarely dealt with gifts of vehicles, works of art, books, coin collections, or other tangible property, we are more than willing to consider such. The process would be for you to either obtain a professional value appraisal of the item before donation or to accept the cash value obtained at sale as your donation value. Please contact the UUFC Business Manager – businessmgr@uucorvallis.org – if you are considering a donation of this type. The UUFC Board of Directors reserves the right to review the acceptance of restricted gifts and to refuse such gifts if they do not seem to fit the mission of the UUFC.

Legacy Giving at Death

There are several ways by which you can provide a legacy gift to the UUFC at your death. The most common options are listed below”

Bequests are gifts specified in your will. By specifying the UUFC as a beneficiary in your will, you can make a charitable commitment while retaining full use of your assets during your lifetime. Simple bequests can be made by including sentences like these in your will:

For cash: “I give, devise, and bequeath to the Unitarian Universalist Fellowship of Corvallis, Oregon, a nonprofit organization, the sum of ____ dollars ($____).”

For a specific percentage: “I give, devise, and bequeath to the Universalist Fellowship of Corvallis, Oregon, a nonprofit organization, an amount equal to _____________ percent (_______%) of the value of my estate at the time of my death.”

For a residual bequest: “I give, devise, and bequeath all of the residue of my estate, both real and personal, to the Unitarian Universalist Fellowship of Corvallis, Oregon, a nonprofit organization.”

For real estate: “I give, devise, and bequeath to the Unitarian Universalist Fellowship of Corvallis, Oregon, a nonprofit organization, the following described real property: (give address or physical location).”

For equities: “I give and devise to the Unitarian Universalist Fellowship of Corvallis, Oregon, a nonprofit organization, all (or some percentage or specific number) of my shares in XYZ company.” Charitable Gift Funds are available at Vanguard Investments and Fidelity Investments to enable you to split a large donation of securities among several organizations. If you need guidance in this regard, the national Unitarian Universalist Association (UUA) Stewardship and Development staff can assist https://www.uua.org/offices/staff/stewardship-development

Charitable Annuities can provide a significant donation and at the same time provide an income cash flow for you and/or your other beneficiaries. The UUA Stewardship and Development staff can again assist you with a charitable annuity to benefit one or several UU organizations. See this for more information http://plannedgiving.uua.org/charitable-gift-annuities.

Retirement Plans offer an easy way to benefit the UUFC by naming us the residual beneficiary of your IRA, 401(k) or other retirement plan. Such a gift avoids the income tax that is otherwise due on the distribution of the remaining value of the funds. Contact your fund advisor for the paperwork needed to name the UUFC as a beneficiary.

Real Estate can provide an income tax deduction for the full value of the real estate and will avoid the capital gains tax on investment property. It is possible to make a gift of your home or vacation home that includes use of it during your lifetime under a life estate arrangement. Contact your financial/legal advisor about options. You can also contact the national Unitarian Universalist Association (UUA) for advice: http://plannedgiving.uua.org

Life Insurance can be given to the Fellowship in several ways. A gift of an active policy is immediately deductible as a charitable donation. If you assign a policy to the Fellowship while you continue to pay premiums, the premiums will be deductible contributions. Or you may name the Fellowship as the beneficiary on your policy. Contact your life insurance provider about the paperwork needed to include the UUFC as beneficiary.

A Living Revocable Trust is a common instrument in which you establish a will, power of attorney, and other estate planning elements. Cash, real estate or residuary gifts to the UUFC and other groups can be set up in a trust. You will need to consult an attorney to create a trust, but the peace of mind and estate planning that can be obtained through a comprehensive trust is significant.

LIMITATIONS ON GIFTS

Because the needs of the UUFC are constantly changing, and it is difficult to look ahead and see exactly what activities of the Fellowship will need assistance at any particular time, it is hoped that donors will not place limitations on gifts. However, if you wish to limit the use of a gift to a special purpose (adult education, a building program, youth activities, etc.), such limitations can be imposed. The simple way to create such a limitation is to add to the terms of the gift: “to be used exclusively for the purpose(s) of XX.” Use of the gift would then be limited to the purpose(s) specified. The UUFC Board of Directors reserves the right to review the acceptance of restricted gifts and to refuse such gifts if they do not seem to fit the mission of the UUFC.

GIVING BY TEXT

You can text the amount you would like to give to 541-502-3200.

Example: text “$10 monthly” to give $10 to

this month’s Justice Outreach recipient.

Our Mission

Explore. Love. Act.

We gather as an inclusive religious community to search for meaning, build deep connections, and inspire action toward a better world for all.